Facts About Personal Loans copyright Uncovered

Facts About Personal Loans copyright Uncovered

Blog Article

Examine This Report about Personal Loans copyright

Table of ContentsThe 10-Minute Rule for Personal Loans copyrightRumored Buzz on Personal Loans copyrightEverything about Personal Loans copyrightThe Main Principles Of Personal Loans copyright The Facts About Personal Loans copyright Uncovered

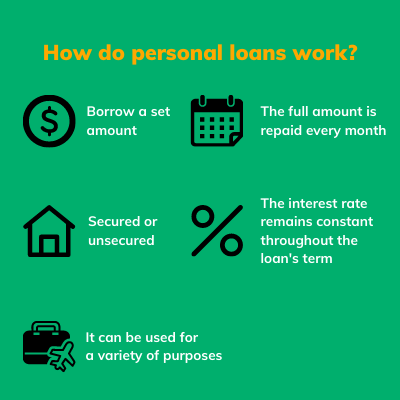

Allow's dive right into what an individual finance actually is (and what it's not), the reasons individuals utilize them, and how you can cover those crazy emergency costs without tackling the concern of financial debt. An individual financing is a lump sum of cash you can borrow for. well, practically anything.That doesn't consist of obtaining $1,000 from your Uncle John to assist you spend for Christmas offers or allowing your flatmate spot you for a couple months' rental fee. You shouldn't do either of those things (for a number of factors), but that's practically not a personal finance. Individual lendings are made through a real monetary institutionlike a bank, lending institution or on the internet lending institution.

Allow's have a look at each so you can know specifically how they workand why you do not require one. Ever before. A lot of individual finances are unsafe, which implies there's no security (something to back the finance, like a vehicle or house). Unprotected lendings typically have greater rate of interest and require a far better credit report because there's no physical thing the loan provider can eliminate if you don't pay up.

Getting The Personal Loans copyright To Work

No issue how excellent your credit is, you'll still have to pay rate of interest on the majority of individual finances. Safe individual car loans, on the other hand, have some kind of security to "safeguard" the funding, like a watercraft, jewelry or RVjust to name a few.

You could also obtain a safeguarded personal car loan utilizing your automobile as collateral. However that's a harmful move! You do not want your main setting of transport to and from work obtaining repo'ed since you're still paying for in 2014's cooking area remodel. Count on us, there's nothing protected concerning protected lendings.

Simply since the repayments are foreseeable, it does not suggest this is a great deal. Personal Loans copyright. Like we stated previously, you're practically guaranteed to pay interest on a personal funding. Just do the mathematics: You'll wind up paying method much more in the future by obtaining a car loan than if you would certainly simply paid with cash money

Everything about Personal Loans copyright

And you're the fish holding on a line. An installment financing is a personal funding you pay back in dealt with installments in time (normally when a month) until it's paid completely - Personal Loans copyright. And don't miss this: You need to pay back the initial car loan amount before you can borrow anything else

Don't be misinterpreted: This isn't the exact same as a credit score card. With personal lines of credit report, you're paying interest on the loaneven if you pay on time. This type of financing is extremely difficult because it makes you believe you're managing your financial debt, when really, it's handling you. Cash advance.

This one obtains us riled up. Because these services prey on people who can not pay their bills. Technically, these are short-term fundings that give you your paycheck in advance.

The Buzz on Personal Loans copyright

Because things obtain real untidy real quick when you miss out on a settlement. Those creditors will certainly come after see here your sweet granny that guaranteed the financing for you. Oh, and you should never ever guarantee a finance for any person else either!

All you're really doing is utilizing brand-new financial debt to pay off old financial debt (and prolonging your lending term). Business understand that toowhich is exactly why so numerous of them supply you debt consolidation car loans.

:max_bytes(150000):strip_icc()/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

And it starts with not obtaining any type of even more money. Whether you're assuming of taking out a personal car loan to cover that kitchen area remodel or your overwhelming credit card bills. Taking out financial debt to pay for things isn't the means to go.

Personal Loans copyright for Dummies

The very best thing you can do for your economic future is obtain out of that buy-now-pay-later attitude and claim no to those spending impulses. And if you're thinking about an individual loan to cover an emergency situation, we obtain it. Obtaining money to pay for an emergency situation only intensifies the tension and hardship of the scenario.

:max_bytes(150000):strip_icc()/how-apply-personal-loan.asp-final-e0c4e2e22f254e54a6cdf927b0a4f8ab.jpg)

Report this page